The great Ken Fisher routinely makes a crucial point in speeches that investors would be wise to heed: your information is already priced. Whatever you think you know, or whatever you think looms as a huge catalyst for a stock-market correction or surge is, if real information, already priced into stocks. So don’t let what you know, or what you think you know, inform your investment decisions.

Fisher’s advice came to mind a great deal on Monday and Tuesday of this week, and with stocks deeply in the red. The headlines were nearly uniform about “Coronavirus fears” existing as the cause of the market correction. The headlines didn’t make sense.

To see why, readers might consider Apple Computer. Apple rates strong consideration when it comes to understanding the market correction when it’s remembered how much stock-market advances over the last few years have been a consequence of Apple, Amazon, Alphabet, Facebook and Microsoft. Take those five companies out of the S&P, and the booming market of the last few years isn’t booming nearly as much.

Apple announced last week that the Coronavirus development might limit manufacture and sales of its products. In short, Apple was already priced. Investors already knew the virus might impact one of the world’s most valuable companies negatively. It should be added that it was already in the news last week that Amazon, fearful of supply disruptions, would be increasing its near-term purchases of inventory with these disruptions in mind.

Despite all of this news in the marketplace, there wasn’t a major correction in shares. Without minimizing Coronavirus and its impact on people and production, investors have been pricing it for several weeks. Markets lurch in either direction once again based on surprise, and Coronavirus was no longer that.

Still, stocks declined a fair amount last Thursday and Friday, and then share declines picked up speed on Monday and Tuesday of this week. Something new jolted investors that seemingly wasn’t apparent to them midway through last week. What was it?

In aiming to answer the question, it should be said that doing so is a fool’s errand. That’s why headlines about what caused stocks to go up or down are so ridiculous in real time, and positively preposterous when looked at in hindsight. If headline writers possessed a clue about what moves stocks, or even if they possessed a clue about whom to ask about what moves stocks, they wouldn’t be headline writers.

That’s a long way of saying that the assertion you’re about to read is a speculation. At the same time, it cannot be stressed enough that surprise moves markets. In that case, what was last week’s surprise, and what was the surprise that reached investors over the weekend?

For a clue on the presumed surprise, readers should first look back in time to 2015 and 2016. At the time, Donald Trump was making a big, and rather unexpected political splash. Odd about his polling strength was that he was polling well among Republicans even though his rhetoric was anti-immigration, anti-trade, plus it was in all-too-many ways pro-big government. Markets corrected at varying times amid news about Trump’s strength, and one investor explained what was happening to me rather succinctly: “Market’s probability of Trump as president in June? 0%. Today, say what you will, maybe 10%. At least that is what various prediction markets are saying. So, I need to discount 10%.”

Early on Trump’s candidacy was viewed by all-too-many as a joke until it was no longer a joke. Count yours truly as one of those laughing. Needless to say, Trump’s electoral strength was real, it became progressively more real, and investors had to price this reality.

Which brings us to last week. For weeks media members had been marveling at the hundreds of millions spent by Michael Bloomberg, a wildly successful and economically moderate Democratic candidate for President of the United States. Though Bloomberg hadn’t participated in the Iowa and New Hampshire primaries, it was broadly assumed that he was a major contender for the Democratic nomination, and precisely because he’s worth tens of billions, Bloomberg was seen as a much more than reasonable opponent of Trump.

Capitalist versus capitalist, though in Bloomberg’s case he could buy and sell Trump many, many times over. Better yet, success for Bloomberg in the Democratic primaries would signal that the Democrats had seen semi-socialists in Bernie Sanders and Elizabeth Warren, only to reject their rather expansive vision of government in concert with Sanders’ particular disdain for business and businessmen. In choosing a billionaire businessman, Democratic voters would be saying that while progressive, they recognize the importance of capitalistic achievement to progress, and that they recognize the need to limit government somewhat.

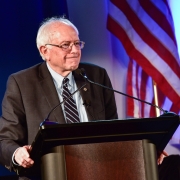

In the debates last week Bloomberg was thoroughly attacked by his opponents precisely because his opponents sensed he was ascending to frontrunner status. The big problem was that Bloomberg allowed himself to be throttled. And he was throttled despite it being known that he had the best, most seasoned advisors preparing him for the attacks that everyone knew were coming. Bloomberg’s performance was roundly panned, and in the estimation of more than a few pundits, Bloomberg’s candidacy was rendered a past tense concept. In short, the lone capitalist on the Democratic side was pushed aside during the Democratic debates; debates from which a rising semi-socialist in Sanders emerged largely unscathed. Keep in mind that Sanders emerged unscathed even though he basically tied Pete Buttigieg in Iowa, and beat the former South Bend mayor in New Hampshire.

Oh well, the crushing of Bloomberg in concert with continued strength for a semi-socialist had to be priced by investors. Some say Sanders has no chance at winning the White House, but they said the same about the current White House occupant. Sanders’s success had to be accounted for, and markets went south last Thursday and Friday. And then on Saturday, investors were confronted with an even bigger surprise: not only was Sanders the frontrunner in the Democratic presidential primary, he was the frontrunner in dominant fashion.

Readers must view Sanders’s Nevada win in the context of national elections. While presidents aren’t dictators, and while they must invariably govern from the center, Sanders would be a big departure from Trump in an economic sense. Trump, for all of his weaknesses, is ultimately quite a bit more free market in actions than his rhetoric would indicate. Sanders? Who knows? While it says here that he would again move to the center, Trump he’s not.

And since he’s not, investors always looking into the future had to price in the possibility of major change in Washington; major change that would have a global impact. This perhaps explains a global rout for shares. Sanders was a big surprise that investors had to price.

Coronavirus? It doesn’t diminish it to point out that investors had long been pricing it. Bernie Sanders was the odd Swan whom investors were forced to reckon with in the past week. That’s the speculation from here.

This piece ran in RealClearMarkets

John Tamny

John Tamny, research fellow of AIER, is editor of RealClearMarkets.