Over the last year, news of crypto hacks and heists became so prevalent that the new breaches were hardly worthy of reporting anymore. Among the headliners, however, was the Coincheck case, the Japanese exchange that lost over $530 million worth of the NEM cryptocurrency, as was Zaif, another exchange also from Japan, that saw $60 million worth of digital currencies vanish. Bancor, an Israeli-Swiss decentralized exchange lost $23 million to a hack this past summer, while BitGrail, a small Italian cryptocurrency exchange lost $170-195 million worth of its customers’ digital assets. All in all, nearly $1 billion was lost to hackers from exchanges and other platforms in just the first nine months of 2018, according to research by blockchain security firm CipherTrace.

An increasing number of ICOs also has come under the spotlight and attracted the attention of government agencies throughout the world. By July 2018, around $1.3 billion had already been invested in fraudulent ICOs, according to a report by Satis Group. The list of ICOs that turned out to be scams is long and it keeps growing. Among the most high-profile cases was OneCoin, an Indian operation that scammed investors for around $350 million, as was the Centra Tech, a heavily promoted and celebrity-endorsed swindle that raised a $32 million through its ICO, only to be indicted for securities fraud. Overall, even when looking at the projects that were not blatantly fraudulent or had their founders vanish with investors’ money, more than 55% of ICO-funded endeavors failed within 4 months, according to a study Boston College.

All in all, some of the blame can be assigned to the extraordinary levels of greed that prevailed in the market, along with irrational optimism and a serious lack of attention to detail. Many of the investors who fell victim to the fraudsters didn’t even bother to read the corresponding white papers or do any kind of research before climbing on the bandwagon. It is also important to bear in mind that, much like in any other bubble, a considerable number of people who entered the market after the rally made headline news did not even have a basic understanding of the principles behind Bitcoin or any other coin they were investing in. Key concepts and mechanisms critical to the function of most crypto-related projects were and still remain largely elusive. For example, in the general public, 80% of people who have heard about the blockchain, have no idea what it actually is, as an HSBC poll showed.

“Doesn’t do what it says on the tin”

Beyond regulation and security issues, one of the main obstacles that many projects in the sector faced is that their products simply didn’t work as they were supposed to. Functionality is the bare minimum any investor and ordinary user would reasonably expect for their money and that expectation in many cases was not met.

A prime example is Bitcoin, originally promoted as a new, better, decentralized currency. While it performed exceedingly well (for some) as a speculation vehicle, it was a dismal failure as a currency. It was so badly designed and so unfit for this purpose, that the more users it attracted, the less usable it became. It goes far beyond Bitcoin too. According to an analysis by “Invest in Blockchain”, out of the top 100 cryptocurrencies in terms of market cap, less than half serve any useful function or actually have a working product.

The way forward

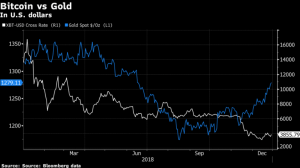

At the height of the crypto-rally, there were many who compared Bitcoin to gold and claimed that it could replace the precious metal. Of course, with the benefit of hindsight, such an idea now seems quaint and ludicrous. This was especially highlighted by the comparative performance of both Bitcoin and gold during the recent volatility extremes and investor anxiety levels in the stock market. As is historically the case, investors running for cover and seeking a safe haven turned to gold. As for Bitcoin, it became clear that it just does not enjoy the same trust from investors and not even the recent turmoil in equity markets could suffice to halt its descent.

The crypto-crash was a painful lesson on greed and on the downside of bandwagon mentality and it provided a much-needed reminder that “a fool and his money are soon parted”. However, it also served as an important catalyst for the industry. This dramatic thinning of the herd, eliminated many operations that were either fraudulent, unsustainable or simply not competitive enough. Much like the DotCom bubble, that eventually cleared the board for giants like Amazon to thrive and to fundamentally change the consumer landscape, this crash has also paved the way for the truly great ideas to flourish, the ones with the potential to impact significant change in the way we do business and interact.

The new and better ideas that the crash has made room for, is not the only reason to be optimistic about the future of the sector. It has also made a difference on the funding side. The significant drop in investment is not necessarily detrimental to the industry in the long run. For one thing, the excesses and waste that were facilitated by the exuberant investments and irrationally high valuations during the 2017 rally are now a thing of the past. The projects that survived and those that will be launched from this point forward face serious pressures to be operationally lean. As speculators and naive investors who were focused on “get rich quick” pitches have largely left the crypto arena, the focus has shifted to sustainable, functional and effective solutions that provide real value to their users and reliable profits to their investors. Thus, from an investing point of view, the crypto sector, as it matures, is bound to offer much more, much greater and much healthier opportunities to those seeking dependable growth.

After all, we must keep in mind that the blockchain technology and its currency applications that we’ve seen in the recent past are two different things. Bitcoin and the hundreds of other cryptocurrencies are but a single facet, just one of many possible uses for the distributed ledger technology. Blockchain has a wide variety of potential applications, already being developed, that hold great promise for cross-industry innovation: communications systems, industrial uses, quality assurance, logistics, law, trade applications and beyond.

As outlined in my previous article on this topic, there is no need to see precious metals and the crypto sector as competitors. If anything, the various solutions that are likely to emerge from the burgeoning industry, especially those with a monetary or transaction-facilitation focus (as we will examine in an upcoming article), are much more likely to threaten the future of government-controlled, fiat money. As the internet irreversibly separated our physical lives from our online activities and as the latter continuously gains ground, it is becoming clear that the tools we used so far to navigate and interact in both domains are no longer fit for purpose in an increasingly connected world.

The concept of national currencies, centrally controlled and manipulated by governments, is antithetical to the culture and the entire point of the internet. On top of that, fiat money is simply not as functional in online transactions as a specifically designed alternative, native to that realm, would be. Thus, we are bound to see the rise of “internet money”, with private and competing cryptocurrencies, able to offer stability, usability, security and convenience, providing much better and much more efficient solutions. Such a shift toward private initiatives and new concepts that enable commercial activity and online payments could soon push fiat money back into the confines of the increasingly irrelevant physical world.

On the other hand, physical precious metals will return to play their essential role as the most liquid and best store of value, as they have done for thousands of years. For investors and savers alike, the appeal of gold is timeless, as it is the only vehicle that has proven to protect and preserve purchasing power, especially in times of crisis.

We are still only beginning to realize the changes, the level of innovation and the vast array of new opportunities that a fully decentralized financial system could bring, operating peer to peer, cutting out the middle man and by doing so, destroying the government monopoly on money. Such a seismic shift would shake the current centralized power structures to the core and soon render them irrelevant. In the meantime, I believe it makes sense to keep an open mind and to familiarize oneself with these new technologies. I do see a lot of potential in systems and concepts that are geared towards digitalizing real assets, such as a physically gold-backed cryptocurrency that can be traded online, bypassing today’s centralized and government-regulated financial system, with its high fees and with transaction times of several days.

It seems to me, that the goal of this generation will be what Friedrich August von Hayek had in mind several years ago: “If we want to maintain a free society, we have to take the money monopoly away from the government”. This process has already begun and it can no longer be stopped, neither by mandate, nor by force.

Claudio Grass, Hünenberg See, Switzerland www.claudiograss.ch

This article has been published at pro aurum. All rights remain with the author and pro aurum.