Those of us living in economically advanced countries can take for granted how easy and inexpensive it is to transfer money between individuals. With payment platforms like Venmo and Paypal readily available, sending and receiving payments is as simple as tapping your smartphone screen a few times.

But for those from poor countries who have left their families and communities behind in search of a more opportunity-rich life in America, sending large sums of money back home comes with a hefty price tag. In fact, by the time the money actually crosses borders and reaches its recipients, between eight and ten percent of the funds have been lost to service fees.

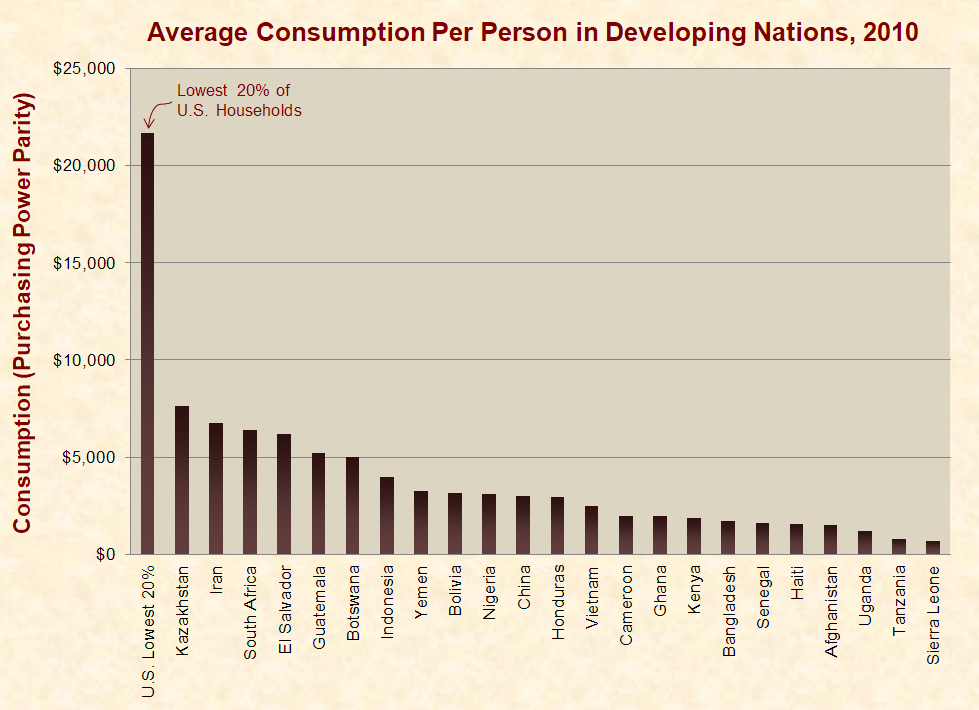

On its face this may seem like a relatively small percentage, but these fees add up quickly, a point Bill Gates recently emphasized when he said, “If the transaction costs on remittances worldwide were cut from where they are today at around 10% to an average of 5%, it would unlock $15 billion a year in poor countries.” It goes without saying that $15 billion can go a long way, especially in underdeveloped countries.

Unfortunately, the regulatory burdens placed on the money transfer industry, known in the finance world as Money Services Business (MSB), have made service fees unavoidable. Since Money Transfer Operators (MTO) must pay extravagant costs before they are allowed to legally conduct any monetary transfers, the sector has seen an increase in the fees pushed to the consumer since these institutions are left to bear the ever-increasing burden of government regulation.

While governments often claim they are committed to helping the less fortunate, it is precisely because of state regulations that those living in underdeveloped regions have had to pay large service fees that make access to capital more difficult, resulting in a large portion of the underbanked population being completely cut off from participating in the global marketplace.

Fortunately, the popularity of cryptocurrencies and blockchain technology are revolutionizing the MSB sector and giving the underbanked populations the opportunity to get ahead economically.

A Labyrinth of Red Tape

The government has made it incredibly difficult for anyone to get involved in the MSB industry or become an MTO. Federal regulations set up to combat money laundering have made this particular industry a huge financial risk for the small businesses that wish to conduct cross-border money transfers and for the banks that store the money these institutions receive.

Before an MSB can conduct any transfers, it must battle its way through a maze of costly red tape on both the federal and state levels. As paymentsviews.com notes:

“Registration with FINCEN and development of an AML Program should cost in the lower 5 figures upfront, with ongoing administration and reporting costs being variable depending on your business. It is compliance with the state requirements that can add up.”

While not all states have occupational licensing requirements for these institutions, many do and the fees are not necessarily a fixed price one can plan for ahead of time. In many instances, a portion of the mandated fees are dependent on the amount of time a government entity spends conducting the background check phase of the process. For those states with fixed permit fees, the costs can range from $250 (Alabama) to $3,000 (New York). But the bad news is, this is not a one-time payment. Most licenses need to be renewed annually, making the regulatory process a constant burden for MSBs and MTOs.

New York’s laws are particularly rigid and collectivist in nature. The annual licensing fees for these businesses are based on their share of the total transaction volume among all license holders in the state. But even in the relatively “business-friendly” state like Texas, the annual fees are anywhere from $1,950 to $15,000 per license.

And on top of all the annual licensing fees, there are other regulations that require fees based on the net worth of the company and these fees by themselves range from $25,000 to $500,000. Additionally:

“You will be required to keep in place a surety bond, or deposit of qualifying securities in lieu of bond in all jurisdictions, dedicated to activities in the jurisdiction. This size of this bond ranges from a base of $10,000 in some small states to $500,000 in New York, with a typical bond requirement being $50,000-$100,000, with the option for the regulators in the jurisdiction to require higher amounts at their discretion. The cost of a bond can be 1-3% of the face amount, and can be higher for higher-risk entities”

Adding insult to injury, the government also requires that you pay for the application and investigatory process, in which your participation is mandatory. Likewise, after you’ve paid all the fees you must also make sure you are complying with all the paperwork requirements, like submitting annual reports and other financial statements to regulators.

Yet, even after you have complied with all the costly regulations, there is no guarantee that your business will be able to secure an account with a bank, something essential to a primarily cash-based business.

Not Worth the Risk

Since many of these businesses operate mainly in cash transactions, as many of the “senders” themselves are part of America’s “underbanked” population, the owners of such establishments are having to routinely deposit large amounts of cash into their bank accounts. While there is absolutely nothing sinister about this, the post 9/11 world has led to increased regulations, especially when it comes to dealing with cash deposits being sent outside the United States. Since banks are monitored heavily by federal regulations, doing business with companies dealing mainly, if not solely, in cash puts targets on the backs of these banks and opens them up to federal investigation.

Fernando Lopez has been the owner of Interamericana Express, an MSB storefront in Atlantic City, for years. Dealing primarily with monetary transfers to Mexico, Lopez and his patrons have contributed to the average of around $24.3 billion that is remitted from the United States to Mexico each year. But even though Lopez has obtained all necessary permits and complied with every law and regulation on the books, Interamericana Express has routinely found that its bank accounts have been frozen or shut down altogether.

Since cash deposits are so heavily regulated, it is not in the bank’s interest to conduct such business. In fact, even large banks like Bank of America and JPMorgan Chase have abandoned their own money transfer programs since the risk is not worth the benefits received. Additionally, Citigroup recently experienced firsthand the harsh realities of the overly-regulated MSB sector when it was forced to pay $140 million for a “failure to safeguard” against money laundering.

Since banks cannot confirm the identity or origin of the cash deposited by these MSB institutions, it is a huge liability, which is why many banks just stopped participating in this market altogether. But for those who are still willing to work with these MSBs, they are able to raise the price since it is both a high-risk transaction on the part of the bank and, to put it frankly, the MSBs no longer have a lot of options when it comes to finding a financial institution willing to work with them.

Luckily, blockchain technology is offering a modern solution to this outdated problem that is not only making cross-border money transfers more affordable but also giving the underbanked populations of the world a chance to become major participants in the global economy.

Enter The Blockchain

While governments love to claim they are committed to helping the less fortunate, it precisely because of state regulations that these underdeveloped regions of the world have had to wait so long to become participants in the global marketplace.

But unfortunately, under the current system, the obstacles to cross-border money transfers don’t end with service fees. For those on the receiving end of cross-border monetary transfers, finding the means to actually “cash out” and physically receive the funds presents a whole separate set of issues. When living in isolated or otherwise remote regions sometimes thousands of miles away from the nearest bank, accessing these funds becomes a feat all of its own.

Without access to traditional financial institutions, the money is often useless unless one has the means to travel to a location that can help facilitate the final phase of the transfer. But a new tech startup is addressing both the high costs and bank accessibility problems associated with cross-border transfers.

Boston-based startup accelerator “MassChallenge” recently announced its 2017 finalists who will be on the receiving end of funding to be used towards their respective endeavors. Among the finalists selected this year was the company “Token Labs,” a startup which utilizes blockchain technology to make cross-border peer-to-peer payment transfers both affordable and more accessible to the underbanked populations.

CEO and co-founder Dave Aiello describes his startup’s mission as:

“Enabling people to easily send bitcoin peer-to-peer around the world. We also connect them with local Bitcoin exchanges in their country so they can receive their local currency for Bitcoin wherever they may be.”

Not only is the Token platform aiming to reduce service fees from ten percent down to one percent, they are also solving the problem of underbanking in impoverished or otherwise underdeveloped regions of the world. Instead of having to worry about finding a bank in order to cash in on the sent funds, cryptocurrencies, like Bitcoin, are allowing those in unbanked and underbanked areas to access the money almost instantaneously.

The blockchain has allowed for such a hassle-free transfer of money largely because smartphones are so prevalent even among the underbanked. While this may sound like a shocking assertion, a study released by the FDIC found that “more than two-thirds of unbanked households (68 percent) and more than 90 percent of underbanked households own a mobile phone. While smartphone ownership lags somewhat among the unbanked (33.1 percent), underbanked households (64.5 percent) are more likely to have a smartphone than the fully banked (59 percent).”

Since cryptocurrency can now be purchased, managed, and transferred via smartphone apps like Token, the need for a traditional banking institution has become almost obsolete. In fact, in many regards, those in underbanked and even unbanked regions are surpassing America and other first world nations when it comes to innovating the entire banking industry. While this may sound like a stretch, the reason for this advancement is a direct result of smartphone technology.

While those in these regions have been largely left out of participating in the global economy, the invention of smartphones has made blockchain technology and thus, cryptocurrency a major game changer. Essentially, those living in these undeveloped regions have completely skipped past the era of centrally controlled banks, and have instead sprung forward and embraced the world of decentralized cryptocurrencies made possible because of the blockchain.

While blockchain enthusiasts like Aiello bring a great deal of hope to those wishing to liberate the world from the strain of regulation and centralization, the government still poses the same threat it always has, even if, for the time being, the blockchain remains almost impenetrable by the state.